The NRI Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 22 October 2023.

With the number of Indians travelling abroad at its highest level, many of us will have to decide how much cash to carry on our international flights. Even though it is safer to carry money as a credit or debit card, there are some situations where we have to keep some currency notes for our day-to-day expenses.

Indian Customs Cash Limit 2023

There are specific guidelines by the Reserve Bank of India (RBI) on the maximum limit of cash that can be carried through Indian airports by travellers including residents, NRIs and foreign tourists.

This article explains the Indian Customs rules for carrying cash as well as the cash limit allowed at Indian airports (Indian Rupees and Foreign Currency) while travelling to and from India.

Table of Contents

Cash Limit on Indian Currency At Indian Airports

According to the Central Board of Direct Taxes and Customs (CBDTC) guidelines, a resident of India who is returning from a visit abroad is allowed to bring in or take out Indian currency up to Rs 25,000.

NOTE: A person coming to India from Nepal or Bhutan may bring Indian currency notes only in denominations not exceeding Rs 100 (which means currency notes of Rs 200, Rs 500 and Rs 2,000 are not allowed).

| Traveller Type | Indian Rupees | Foreign Currency |

|---|---|---|

| Indian residents returning from a visit abroad | Rs 25,000 | Unlimited (see condition 1 below) |

| Indian residents going abroad | Rs 25,000 | Unlimited (see condition 2 below) |

| Foreigners* or NRI coming to India | Rs 25,000 | Unlimited (see condition 1 below) |

| Foreigners* or NRI going back from India | Rs 25,000 | Not more than what was bought in by them |

* If the traveller is a citizen of Pakistan and Bangladesh or coming from and going to either of the countries, carrying Indian currency is not allowed.

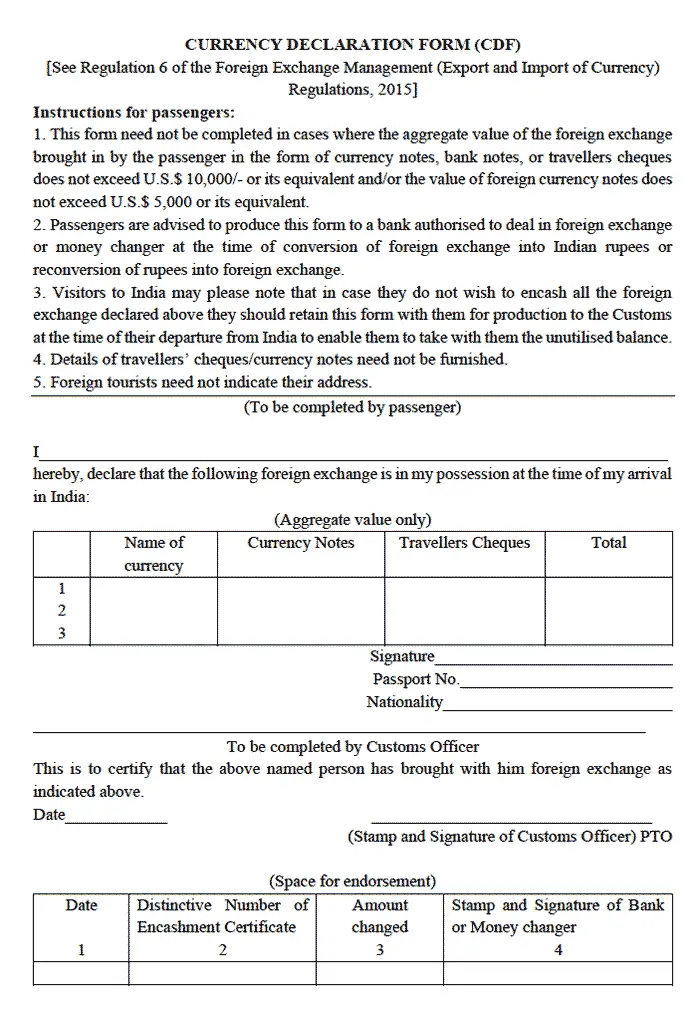

Condition 1: Passengers carrying foreign currency have to fill up a Currency Declaration Form (CDF) before Custom officers in the following cases:

- Where the value of foreign currency notes exceeds US$ 5,000 or equivalent.

- Where the aggregate value of foreign exchange including currency exceeds US$ 10,000 or equivalent.

| Foreign Currency Value | Declaration Required |

|---|---|

| Foreign Currency value less than US$ 5,000 | No |

| Foreign Currency value equal to or more than US$ 5,000 | Yes |

| The total value of Foreign Exchange is equal to or more than US$ 10,000 | Yes |

Condition 2: Foreign currency taken out of India has to be purchased/issued by an RBI-approved/authorized foreign exchange dealer as per norms.

Exceptions Allowed With RBI Permission

According to Foreign Exchange Management (Export and Import of Currency) (Amendment) Regulations, 2020, “the Reserve Bank may, on an application made to it and on being satisfied that it is necessary to do so, allow any person to take or send out of India to any country or bring into India from any country currency notes of Government of India and /or of Reserve Bank of India subject to such terms and conditions as the Reserve Bank may stipulate.” (source)

Cash Limit on Foreign Currency At Indian Airports

According to CBDTC, any person (Resident, NRI or Tourist) can bring into India, from a place outside India, foreign currencies without any limit (subject to declaration limit).

| Traveller Type | Maximum Limit |

|---|---|

| Residents, NRIs or Tourists bringing Foreign Currency to India | Unlimited (see condition 1 above) |

| Residents taking Foreign Currency out of India | Unlimited (see condition 2 above) |

| NRIs or Tourists taking Foreign Currency out of India | Not more than what was bought in by them |

Passengers can also use the ATITHI app to file a declaration of dutiable items as well as currency with Indian Customs even before boarding the flight to India.

Currency Limit When Going Abroad From India

Indian residents travelling abroad can take Indian currency notes (Indian rupees) not exceeding Rs. 25,000. Indian residents who went outside can also bring back Indian currency notes not exceeding Rs. 25,000.

Non-residents, tourists including foreign citizens (except citizens of Pakistan or Bangladesh),

- may take outside India currency notes up to an amount not exceeding Rs. 25,000 per person *

- may bring into India currency notes up to an amount not exceeding Rs. 25,000 per person *

*or such other amount and subject to such conditions as notified by the Reserve Bank of India from time to time.

How much money we can carry on international flights from India?

Indian residents travelling abroad can take foreign currency without any limit. This is as long as the same has been purchased or issued by an RBI-approved/authorized foreign exchange dealer as per the norms.

Tourists or NRIs while leaving India are allowed to take with them foreign currency not exceeding an amount brought in by them i.e. unspent foreign exchange left over from the amount declared in the Currency Declaration Form at the time of their arrival in India.

Important Tips On Currency Declaration Form

In case a visitor to India does not wish to encash all the foreign exchange declared on arrival they should retain the Currency Declaration Form with them for production to Indian Customs at the time of their departure from India to enable them to take with them the unutilised balance.

No declaration is required for bringing in foreign exchange/currency not exceeding US$ 5,000 in currency notes or its equivalent. This is also applicable to foreign exchange in the form of currency notes, bank notes or traveller’s cheques not greater than US$ 10,000 or its equivalent.

Generally, tourists can take out of India with them at the time of their departure foreign exchange/ currency not exceeding the above amount.

How much cash can I carry on a domestic flight in India?

There is no specific limit on the amount of cash that can be carried on a domestic flight in India. However, you are responsible for providing a valid reason and source (with proof) for carrying cash of more than INR 200,000 (Rupees 2 lakhs).

Please note that income tax laws in India prohibit any cash transaction exceeding INR 200,000. Recently, there have been incidents of domestic travellers being caught with cash exceeding this limit.

Foreign Currency Limit For NRI

An NRI coming into India from abroad can bring foreign exchange without any limit.

In case, the total value of foreign currency notes, traveller’s cheques, etc. exceeds US$ 10,000 or its equivalent and/ or the value of foreign currency exceeds US$ 5,000 in currency notes or its equivalent, it should be declared to the Customs Authorities at the Airport in the Currency Declaration Form, on arrival in India.

Foreign Currency Limit for Medical Treatment Abroad

To meet medical treatment expenses outside India, you can purchase foreign currency self-certification for up to US$ 50,000. Banks may also release exchanges for amounts above US$ 50,000 if they receive estimates from doctors or hospitals in India or overseas.

Also, foreign exchange of up to US$ 25,000 is available for the patient and accompanying attendant on self-certification in order to meet boarding/lodging/travel costs.

Foreign Currency Limit for Studying Abroad

The maximum amount of foreign exchange you can buy per academic year is US$ 30,000 or the estimate from the institution abroad, whichever is higher. There must be documentary evidence indicating the requirement.

Important Tips on How To Avoid Currency Issues at Airport

- If you are bringing foreign currency (in big amounts) from abroad, fill up the Currency Declaration form, get it stamped by Customs and keep it with you while returning.

- If you are buying foreign currency from India, buy from an authorised dealer or bank and keep the transaction receipts with you.

- On any travel, keep less than Rs 25,000 in Indian Rupees. Know the additional restrictions if you are travelling to and from Nepal or Bhutan.

Frequently Asked Questions

How much foreign currency can I carry to India?

There is no limit on the foreign currency that you can carry to India. However, you need to file a declaration if the currency value exceeds USD 5,000 or the total foreign exchange exceeds USD 10,000.

How much Indian currency can I carry outside India?

When going abroad, Indian residents, NRIs or Foreigners (except citizens of Pakistan and Bangladesh) are allowed to carry Indian currency notes of up to Rs 25,000.

Do I have to pay any tax on the foreign currency being imported to India?

There is no tax on the foreign currency you are importing to India. You just need to file a declaration if the currency value is above USD 5,000 or foreign exchange is above USD 10,000.

You May Also Like:

- Duty Free Allowance At Indian Airports

- Indian Customs Rules For Gold

- Indian Airport Customs Duty On LCD/LED TV

- Indian Customs Declaration Form

- How NRI Can Change Rs 2000 Currency Notes

Copyright © NRIGuides.com – Unauthorized reproduction of this article in any language is prohibited. The information provided on this website is intended for general guidance and informational purposes only. It should not be considered a substitute for professional advice, and travellers are encouraged to verify visa requirements and travel advisories through official government sources before making any travel arrangements.

Reference: CBEC Customs Guide for Travellers, Reserve Bank of India Circular No. 45/2015, RBI Notification No. FEMA 6 (R)/2015-RB

Aneesh, the Founder & Editor of DG Pixels, holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.