The NRI Guides Team regularly reviews this article to ensure the content is up-to-date and accurate. The last editorial review and update were on 30 October 2023.

Bringing gold into India, a nation known for its deep-rooted affinity for the precious metal, is a common practice among Indians living abroad or those who enjoy investing in gold. However, Indian Customs regulations govern the amount of gold one can bring into the country without incurring duties.

Due to these restrictions, many travelers often ask: “How much gold can I carry to India without duty?”. This article will answer this question and explain the rules and regulations concerning the import of gold into India.

Table of Contents

How Much Gold Can I Carry to India Without Duty?

The Indian government has set specific limits for the amount of gold a person can carry into the country without paying any import duties.

As per the Central Board of Indirect Taxes & Customs (CBIC):

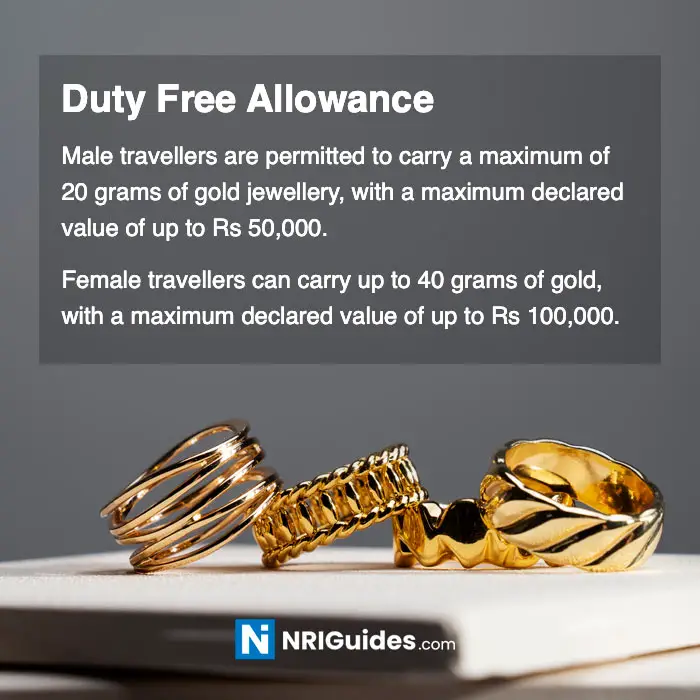

Male travellers are permitted to carry a maximum of 20 grams of gold jewellery, with a maximum declared value of up to Rs 50,000 without incurring any import duties. Female travellers can carry up to 40 grams of gold, with a maximum declared value of up to Rs 100,000 without incurring any import duties.

It’s important to note that these allowances are only applicable if you have stayed abroad for more than a year. If your stay abroad was less than one year, you have to pay the effective customs duty.

Also, please note that the duty-free allowance applies only to gold jewelry for personal use and not for gold coins, gold biscuits, or gold bars.

If you’re traveling as a family, these allowances are generally per individual. So, a family of two males and two females (including children) can carry gold up to the value of Rs 3,00,000, provided they adhere to the regulations.

Since these rules were announced several years ago and the price of gold has increased now, customs officials can calculate the allowance based on the value of gold (not weight). As per the applicable value in 2023, Rs 50,000 allowance for male travelers will be equivalent to 9 grams, and Rs 1 lakh for female travelers will be equivalent to 18 grams.

Carrying Gold More Than Duty-Free Allowance

If you’re carrying more gold than the above-mentioned duty-free allowance, you may be liable to customs duties.

Passengers of Indian origin or Indian passport holders returning to India after a minimum of six months abroad can import gold up to 1 kg by paying a discounted customs duty of 13.75%. If you have stayed abroad for less than six months, the customs duty is 38.5%.

| Period of Stay Abroad | Duty-free Allowance | Duty Payable |

|---|---|---|

| One year and above | Maximum value of Rs 50,000 for males; Maximum value of Rs 100,000 for female | Up to 1 kg: 13.75% |

| Six months to one year | No Allowance | Up to 1 kg: 13.75% |

| Less than six months | No Allowance | 38.5% |

Please note that this should be declared to the officials and the customs duty should be paid in convertible foreign currency. You can read more about customs rules for importing gold here.

Traveling with Gold Jewelry

Gold jewelry, including simple necklaces, rings, and bracelets that women are wearing and is meant for personal use, is typically allowed. However, it’s essential to ensure that these items do not exceed a reasonable and clearly personal amount.

If you take your gold jewelry abroad and return with it, you must declare it and provide appropriate documentation to prove that it was taken out of the country earlier. An export certificate can help establish that the jewelry was taken from India.

Understanding the regulations concerning how much gold you can carry to India without incurring customs duty is crucial for a smooth and hassle-free travel experience. Stay informed about the latest rules, declare your gold items correctly, and keep all necessary documentation.

Related Articles:

- Indian Customs Gold Duty, Allowance and Rules

- Duty-Free Allowance At Indian Airports

- Indian Airport Customs Duty On LCD/LED TV

- Indian Customs Rules for Electronic Items

- Transfer of Residence to India: Customs Rules for NRI

- Indian Customs Cash Limit And Rules

- Indian Customs Declaration Form

Copyright © NRIGuides.com – Unauthorized reproduction of this article in any language is prohibited. The information provided on this website is intended for general guidance and informational purposes only. It should not be considered a substitute for professional advice, and travellers are encouraged to verify visa requirements and travel advisories through official government sources before making any travel arrangements.

Reference: Central Board of Indirect Taxes & Customs, Baggage Rules 2016

Aneesh, the Founder & Editor of DG Pixels, holds a Master’s Degree in Communication & Journalism, and has two decades of experience living in the Middle East. Since 2014, he and his team have been sharing helpful content on travel, visa rules, and expatriate affairs.